OUR STRATEGY

STABILITY AND LOWER RISK

Investing in apartments is a smart choice for those seeking a stable, lower-risk investment compared to stocks and bonds. Multifamily properties consistently perform well even during economic downturns, providing reliable income streams.

STRONG EQUITY GROWTH

Multifamily investments offer tremendous potential for equity growth over time. As property values appreciate, your investment grows, building long-term wealth for your portfolio.

HIGHER MONTHLY RETURNS

Apartments generate consistent monthly rental income, often outpacing the returns you would receive from traditional stock dividends or bond interest. This makes multifamily investments ideal for maximizing your cash ow and overall return on investment

DIVERSIFICATION

By investing in multifamily housing, you can diversify your portfolio, balancing the volatility of stocks and bonds with the stability of real estate. This diversification minimizes risk while enhancing overall performance.

TOP-PERFORMING REAL ESTATE CLASS

Multifamily apartments consistently outperform other real estate asset classes, offering superior returns and long-term stability.

CASH FLOW AND EQUITY GROWTH

Multifamily properties generate significant monthly cash flow while appreciating in value over time, creating strong equity growth

HIGHER OVERALL RETURNS

Our structured investment approach maximizes both income and value, delivering higher overall returns compared to other real estate investments

STABILITY AND LOWER RISK

Investing in apartments is a smart choice for those seeking a stable, lower-risk investment compared to stocks and bonds. Multifamily properties consistently perform well even during economic downturns, providing reliable income streams.

STRONG EQUITY GROWTH

Multifamily investments offer tremendous potential for equity growth over time. As property values appreciate, your investment grows, building long-term wealth for your portfolio.

HIGHER MONTHLY RETURNS

Apartments generate consistent monthly rental income, often outpacing the returns you would receive from traditional stock dividends or bond interest. This makes multifamily investments ideal for maximizing your cash ow and overall return on investment.

DIVERSIFICATION

By investing in multifamily housing, you can diversify your portfolio, balancing the volatility of stocks and bonds with the stability of real estate. This diversification minimizes risk while enhancing overall performance

TOP-PERFORMING REAL ESTATE CLASS

Multifamily apartments consistently outperform other real estate asset classes, offering superior returns and long-term stability.

CASH FLOW AND EQUITY GROWTH

Multifamily properties generate significant monthly cash flow while appreciating in value over time, creating strong equity growth

HIGHER OVERALL RETURNS

Our structured investment approach maximizes both income and value, delivering higher overall returns compared to other real estate investments

Take Advantage of Increased Tax Benefits

Our Team only acquires stabilized (above 80% occupancy) and cashflow positive apartment building investments. This allows our investors to make healthy returns while showing a loss at the end of every year.

Take advantage of 3 types of depreciation that allow investors to lower taxes:

Standard or Straight-line Depreciation

Accelerated Depreciation

Bonus Depreciation

Cost segregation studies are performed on all of our assets. Tax benefits also pass through to our investors via annual year-end reporting on K-1s issued for the preceding year.

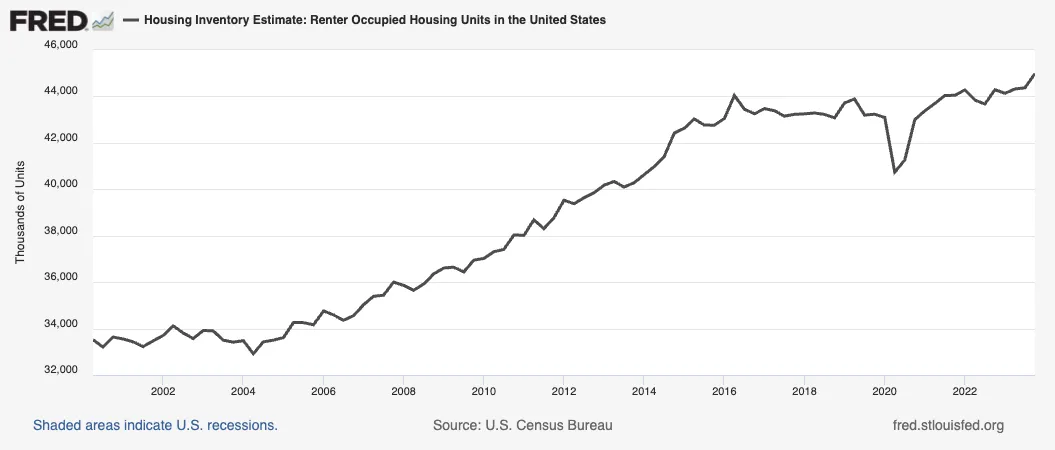

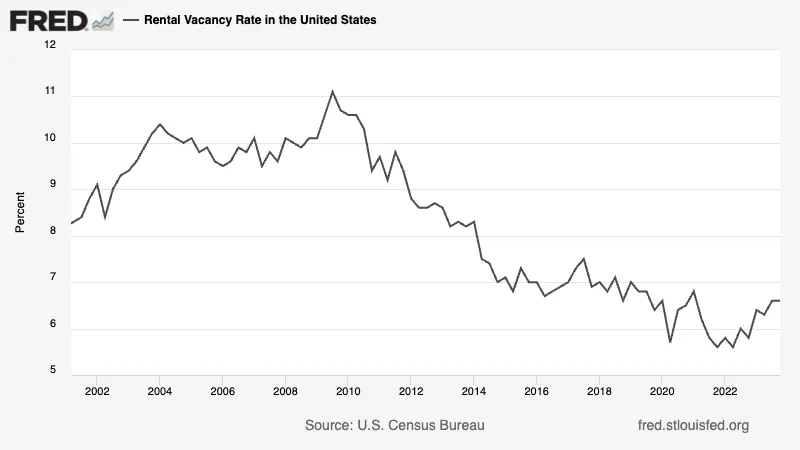

DEMAND FOR APARTMENTS IS AT AN ALL-TIME HIGH AND CONTINUES TO RISE

Since their peak in the mid-2000s, more people are choosing to rent, prioritizing mobility and flexibility in the 21st century. This shift makes multifamily housing a smart investment to capitalize on growing demand.

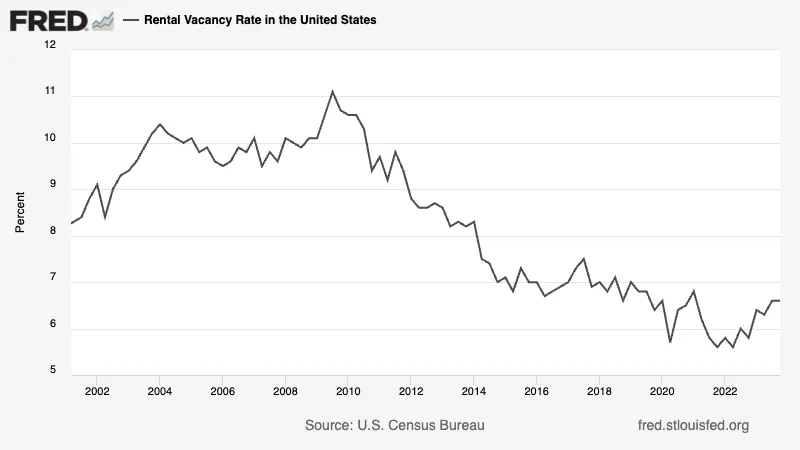

Vacancy rates remain low due to increased demand

Multifamily investments consistently outperform other real estate classes, offering a powerful combination of significant cash flow and equity growth. Through strategic property selection and expert management, apartments deliver higher overall returns, making them the top-performing asset in the real estate market.

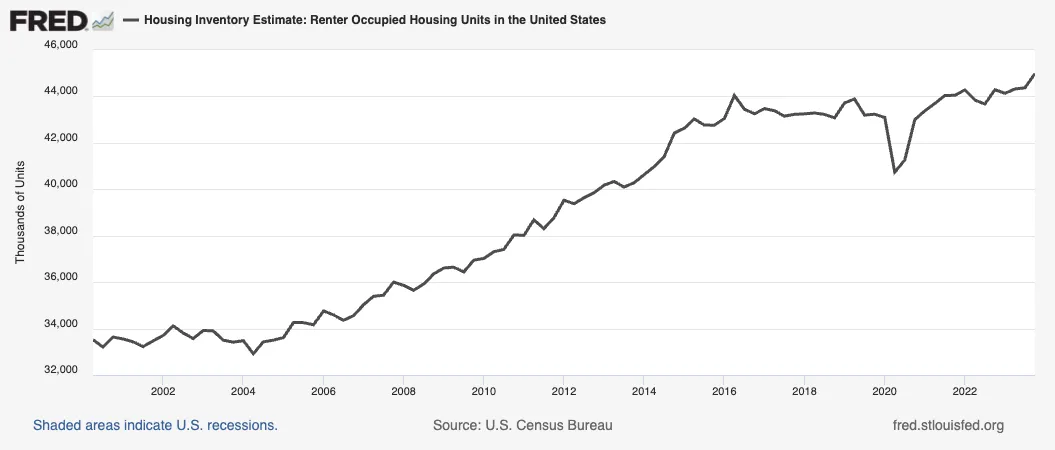

DEMAND FOR APARTMENTS IS AT AN ALL-TIME HIGH AND CONTINUES TO RISE

Since its peak in the mid-2000s, home ownership has been significantly dropping, and it will continue to drop as millennials, and aging baby boomers want to stay mobile in the 21st century.

Vacancy rates remain low due to increased demand

Multifamily investments consistently outperform other real estate classes, offering a powerful combination of significant cash flow and equity growth. Through strategic property selection and expert management, apartments deliver higher overall returns, making them the top-performing asset in the real estate market.